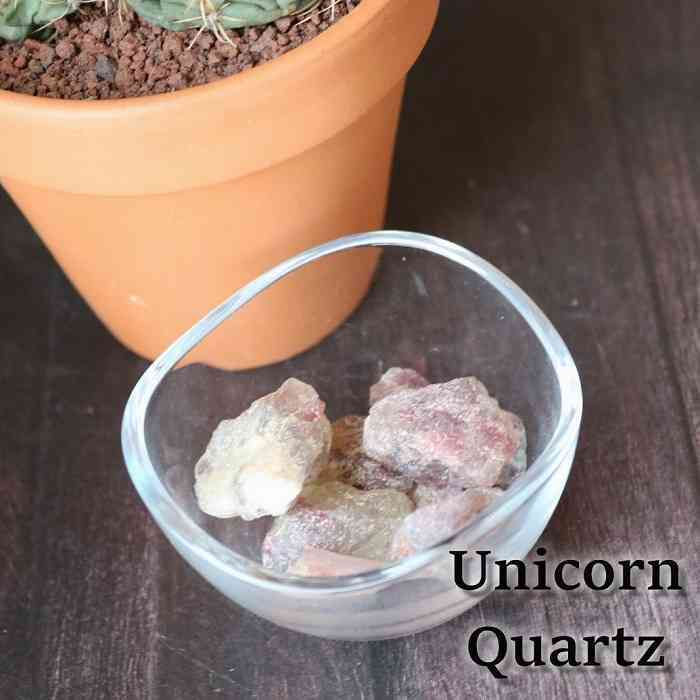

ユニコーン クリスタルクラスター 水晶 天然石

(税込) 送料込み

商品の説明

商品説明

soldout________________________________________

約9.7㎝×8.2㎝×4.1㎝

_________________________________

複数ご購入希望の方はおまとめしますので

コメントお願いいたします

天然石のため

クラック、かけ、石目、凹、

内包物などございます。

ご理解した上でご購入お願いいたします

神経質な方はご遠慮下さい

近いお色味を心掛けておりますが、

お色味に誤差が生じる場合がございます

__________________________________

#フェアリー

#天使

#カーネリアン

#妖精

#オーシャンジャスパー

#桜瑪瑙

#天然石

#クリスタル

#原石

#鉱物

#ローズクォーツ

#フローライト

#水晶

#クラスター

#インテリア

#ポイント

#+1114

3999999円ユニコーン クリスタルクラスター 水晶 天然石インテリア/住まい/日用品インテリア小物夢可愛いユニコーンカラーが楽しめる オーラクリスタル/水晶夢可愛いユニコーンカラーが楽しめる オーラクリスタル/水晶

夢可愛いユニコーンカラーが楽しめる オーラクリスタル/水晶

夢可愛いユニコーンカラーが楽しめる オーラクリスタル/水晶

夢可愛いユニコーンカラーが楽しめる オーラクリスタル/水晶

夢可愛いユニコーンカラーが楽しめる オーラクリスタル/水晶

夢可愛いユニコーンカラーが楽しめる オーラクリスタル/水晶

ユニコーン クリスタルクラスター 水晶 天然石の通販 by +1114|ラクマ

夢可愛いユニコーンカラーが楽しめる オーラクリスタル/水晶

夢可愛いユニコーンカラーが楽しめる オーラクリスタル/水晶

夢可愛いユニコーンカラーが楽しめる オーラクリスタル/水晶

ユニコーン クリスタルクラスター 水晶 天然石の通販 by +1114|ラクマ

夢可愛いユニコーンカラーが楽しめる オーラクリスタル/水晶

ユニコーン クリスタルクラスター 水晶 天然石の通販 by +1114|ラクマ

ユニコーン クリスタルクラスター 水晶 天然石の通販 by +1114|ラクマ

ユニコーン 水晶 - 通販 - www.photoventuresnamibia.com

クリアクォーツ ユニコーン12◇Clear Quartz unicorn◇天然石・鉱石

ユニコーン クリスタルクラスター 水晶 天然石の通販 by +1114|ラクマ

透明水晶にガーデン確認クォーツ ユニコーン 彫り 高さ約125mm 重さ

置物 彫り物 ユニコーン ラルビカイト 知性 合理性を高める お守り パワーストーン 品番:13579

ユニコーン 水晶 - 通販 - www.photoventuresnamibia.com

ユニコーン 水晶クラスター 手彫り その他インテリア雑貨 アトリエ

クリアクォーツ ユニコーン11 Clear Quartz unicorn 天然石・鉱石

クリアクォーツ(水晶)ユニコーン | 天然石・パワーストーンのお店

ユニコーン 水晶 - 通販 - www.photoventuresnamibia.com

置物 彫り物 ユニコーン 水晶 クォーツ 浄化 エネルギー 恋愛運 結婚運 パワーストーン 品番:13577

クリアクォーツ(水晶)ユニコーン | 天然石・パワーストーンのお店

クリアクォーツ ユニコーン13◇Clear Quartz unicorn◇天然石・鉱石

楽天市場】\割引クーポン配布中/ アロマストーン 天然石 ユニコーン

夢可愛いユニコーンカラーが楽しめる オーラクリスタル/水晶

置物 彫り物 ユニコーン 水晶 クォーツ 浄化 エネルギー 恋愛運 結婚運 パワーストーン 品番:13577

ユニコーンストーン タワー32◇ Unicorn Stone ◇天然石・鉱物

夢可愛いユニコーンカラーが楽しめる オーラクリスタル/水晶

クリアクォーツ(水晶)ユニコーン | 天然石・パワーストーンのお店

夢可愛いユニコーンカラーが楽しめる オーラクリスタル/水晶

ユニコーン彫刻水晶 約42g | 天然石•パワーストーンのクリスタル☆ドリーム

ユニコーンオーラ クリスタルポイント 新入荷!! | 天然石ミューゼ

ゼッカ産水晶クリアクォーツ クラスター38◇ Clear Quartz From Zeca

夢可愛いユニコーンカラーが楽しめる オーラクリスタル/水晶

楽天市場】\割引クーポン配布中/ アロマストーン 天然石 ユニコーン

ユニコーンストーン9㎜&水晶 【デザインブレスレット】天然石

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています